Your debt-to-income ratio (DTI) plays a major role in whether you can qualify for a mortgage or refinance — and each loan type has its own rules. Some programs are strict, while others give borrowers far more flexibility, especially if you have strong compensating factors.

Knowing the maximum DTI limits for conventional, FHA, and VA loans helps you understand which programs you’re most likely to qualify for, how lenders view your financial profile, and what steps you can take to strengthen your application.

This guide breaks down the maximum DTI limits for each major loan type, when exceptions apply, and how to choose the loan that best fits your situation.

Key Takeaways

✅ Conventional loans generally cap DTI at 36–45%, though some approvals reach 50%

✅ FHA loans routinely allow DTIs between 31-43%, but can go up to 50% with strong compensating factors

✅ VA loans have no strict DTI cap — approvals depend on residual income and lender requirements

✅ Streamline refinances (FHA/VA) may not require DTI calculations, but this varies by lender

💡 Pro Tip: Many borrowers don’t compare their loan options when applying for a mortgage, even though small improvements in rates or fees can make a drastic difference in their DTI. Don’t make that mistake. Upload your Loan Estimate to Fincast to see if vetted lenders can offer more competitive terms — no extra credit pulls or spam.

What Is DTI and Why Does It Matter?

Your debt-to-income ratio (DTI) measures how much of your gross monthly income goes toward monthly debt payments.

DTI = Total Monthly Debt Payments ÷ Gross Monthly Income

Lenders use DTI to determine:

How much of a mortgage payment you can safely manage

Whether your finances are stretched too thin

Which loan programs you qualify for

Your overall risk profile

Different loan types allow different DTI limits — and some are far more flexible than others.

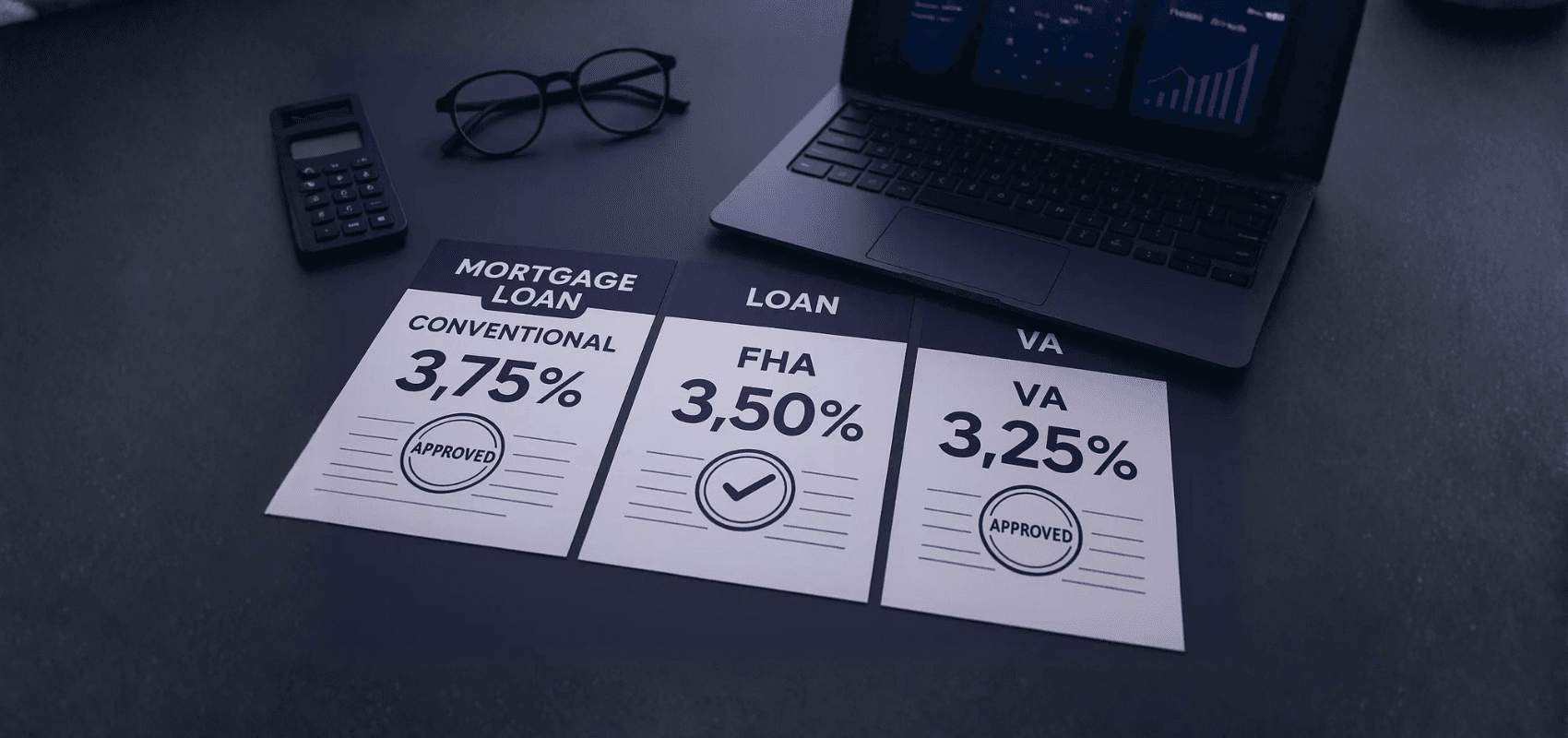

Maximum DTI Limits by Loan Type

Let’s break down conventional, FHA, and VA guidelines — and when lenders allow exceptions.

1️⃣ Conventional Loans: Stricter Limits

Conventional loans follow the guidelines of Fannie Mae and Freddie Mac. These programs are more conservative than FHA or VA, especially for borrowers with low credit scores or limited reserves.

Typical Maximum DTI for Conventional Loans

36–45% is the standard approval range

Up to 50% is possible only when the AUS (Automated Underwriting System) approves the file

Most conventional approvals are driven by automated underwriting systems, versus human underwriters.

You may qualify for up to 50% DTI if you have:

Strong credit (typically 700+)

Solid income and employment history

Low loan-to-value (LTV) ratio

Significant cash reserves

A refinance that reduces your monthly payment

You may be capped at 43–45% if:

Your credit score is below 680

Your income is variable or difficult to document

You're applying for a cash-out refinance

Your loan is high-risk (multi-unit, high LTV, etc.)

Actual lender overlays vary, so it’s best to shop around to find the lender with the most competitive terms and achievable guidelines.

💡 Pro Tip: Conventional financing offers the best pricing for borrowers with strong credit, but DTI caps are stricter than those for FHA or VA loans.

2️⃣ FHA Loans: Most Flexible

FHA mortgages allow some of the highest DTIs in the industry because they’re designed to help borrowers with limited savings, moderate income, or lower credit scores.

Typical Maximum DTI for FHA Loans

31-43% is the standard approval range for manual underwriting

A DTI of 50% or higher may be allowed with strong compensating factors and automated underwriting

FHA may allow up to 50% DTI if you have:

Strong credit history

Verified cash reserves

Stable employment and income

Low payment shock

On-time mortgage payment history

In rare cases, the FHA allows DTIs of up to 57%, but only in very specific automated underwriting situations. It’s best to keep your DTI as low as possible to increase your chances of approval.

FHA Streamline Refinance

If you already have an FHA loan, the FHA Streamline Refinance offers major flexibility:

No income verification required (varies by lender)

No appraisal required (varies by lender)

DTI may not be calculated at all (varies by lender)

💡 Pro Tip: FHA loans can be ideal for borrowers who are close to or above conventional DTI limits.

3️⃣ VA Loans: No Official DTI Maximum

VA loans (available to eligible veterans, active-duty service members, and surviving spouses) are flexible regarding DTI, focusing on residual income rather than strict ratios.

VA’s Official Stance

No maximum DTI requirement (this may vary by lender)

Borrowers sometimes qualify with DTIs above 50%

VA Approval Depends on Residual Income

Residual income is the amount left after paying debts, taxes, and living costs. It’s the key factor in VA underwriting.

As long as you meet the residual income guidelines for your region and household size, you may qualify — even with a high DTI.

VA IRRRL (Streamline Refinance)

A VA streamline refinance:

Does not require income documentation (varies by lender)

Does not require a DTI calculation (varies by lender)

Often does not require an appraisal (varies by lender)

💡 Pro Tip: If your DTI is high but you have high residual income and a clean payment history, VA loans may offer the most flexible approval path for military members and their families.

Side-by-Side Comparison: Maximum DTI by Loan Type

Loan Type | Maximum DTI Allowed | Notes |

Conventional | 36–45% (up to 50% with AUS approval) | Stricter limits; best rates for strong-credit borrowers |

FHA | 31-43% | Most flexible for high-DTI borrowers |

VA | No official max | Approval based on residual income, not DTI |

USDA (bonus) | 41% | Some flexibility with compensating factors |

If your DTI is above 45%, FHA and VA programs often provide the smoothest path.

If your DTI is below 40%, conventional loans may offer the strongest pricing.

Which Loan Type Is Best for Your DTI?

Choose Conventional if:

Your DTI is 40–45%

Your credit is 680–700+

You want a competitive interest rate

You have strong reserves or equity

Choose FHA if:

Your DTI is closer to 50%

Your credit is 620–680

You need more flexible underwriting

You want a softer path to approval

Choose VA if:

You’re eligible for VA benefits

Your DTI is high (50%+)

You have high residual income

You want the least restrictive approval process

Choose Streamline Options if:

You already have an FHA or VA loan

You want a faster refinance with minimal documentation

You need flexibility on DTI requirements

How to Strengthen Your Application Regardless of Loan Type

No matter which loan you choose, your approval is stronger if you:

✔ Lower your credit card minimum payments

DTI improves immediately when revolving debt is reduced.

✔ Avoid new loans before refinancing

An auto loan can increase DTI by several points overnight.

✔ Boost your income (even slightly)

Overtime, raises, or a co-borrower can reduce your DTI quickly.

✔ Show stable employment

Two years in the same field is preferred.

✔ Demonstrate on-time housing payments

This is a major compensating factor across all loan types.

How Fincast Helps You Navigate DTI Limits

Lenders view DTI differently — and many borrowers qualify with one lender but not another. That’s why comparing offers matters.

With Fincast, you can:

Upload your Loan Estimate securely

Let vetted lenders compete privately to beat your terms

Compare side-by-side offers — no extra credit pulls

Choose the one that gives you the best deal

This matters because DTI can affect your rate, your approval, and your overall loan options — and Fincast helps you get clarity fast.

FAQs

1. What’s the highest DTI allowed for a conventional refinance?

Typically 36–45%, but some AUS approvals allow up to 50%.

2. How high can DTI be on an FHA refinance?

Up to 50% with strong compensating factors.

3. Does the VA have a maximum DTI?

No. VA approvals depend on residual income, not a specific DTI limit, but the exact guidelines vary by lender.

4. Do streamline refinances check DTI?

Often, no — FHA Streamline and VA IRRRL usually don’t require a DTI calculation, but this can vary by lender.

5. What if my DTI is too high for conventional?

FHA or VA programs may offer easier approval paths with better flexibility.

Bottom Line

Every loan type has its own DTI limits — and knowing where you fall helps you choose the program that fits your financial situation best. You’re in a strong position when:

✅ You understand each loan’s DTI requirements

✅ You’ve strengthened your application with compensating factors

✅ You’re comparing offers instead of relying on a single lender

A refinance can lower your payment, improve your loan terms, and increase long-term financial stability. Upload your Loan Estimate to Fincast to see whether vetted lenders can offer better terms and help you move forward with confidence.

Disclaimer: Nothing in this content should be considered financial advice. The examples and data shared are for general information only and may not reflect your personal situation. We do not guarantee the accuracy or completeness of the information provided. Always do your own research and speak with a qualified financial advisor before making any financial decisions.