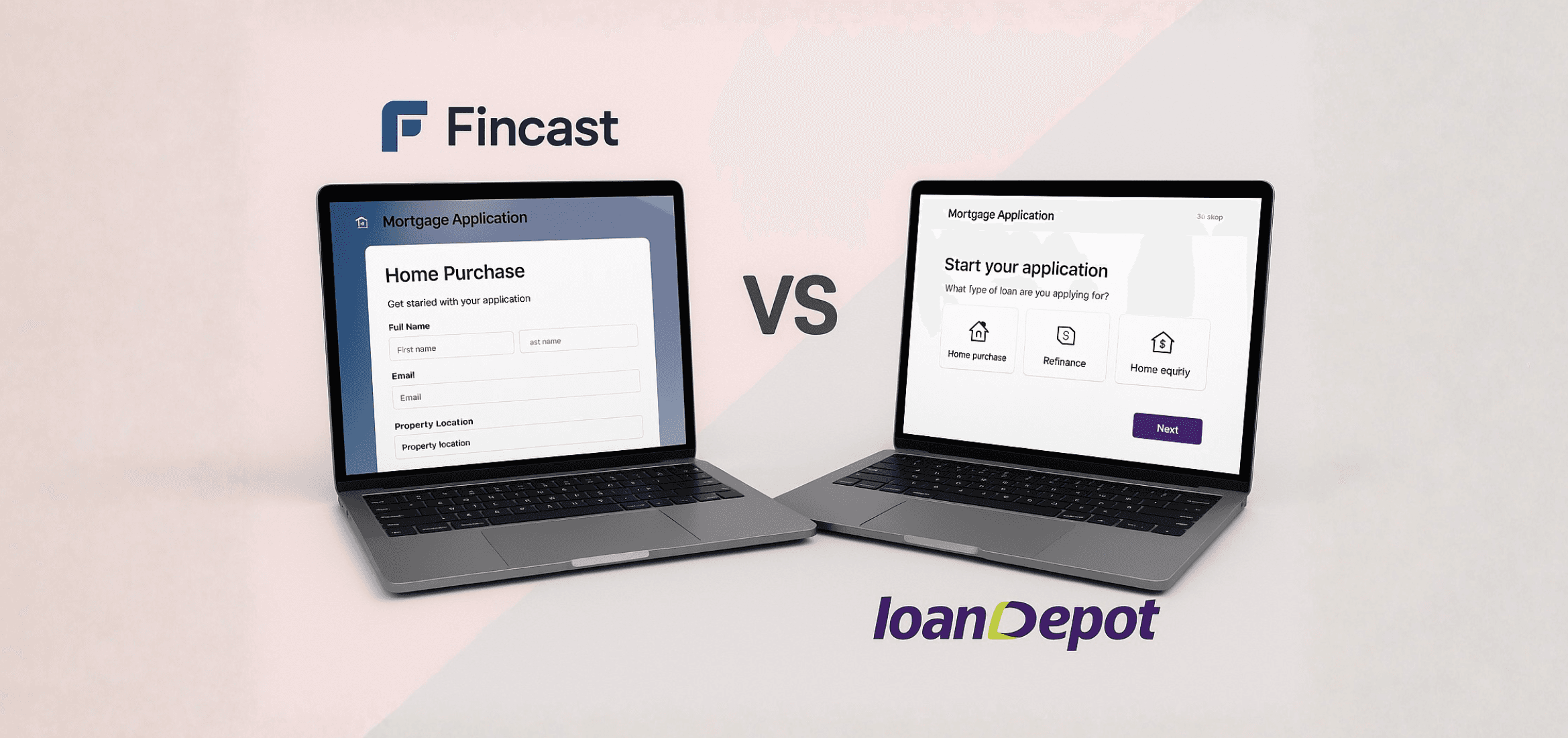

Shopping for a mortgage means you'll encounter many platforms and lenders. Two popular platforms are Fincast and LoanDepot.

Both involve mortgage lending, but they serve different purposes. Fincast is a reverse auction platform that helps you compare offers from multiple lenders. LoanDepot is a direct lender where you apply for a loan directly.

Understanding both helps you shop efficiently and secure your best deal.

Key Takeaways

Fincast: A reverse auction platform that benchmarks your Loan Estimate against vetted lenders, helping you compare offers without duplicate applications or extra credit pulls.

LoanDepot: A hybrid direct lender with 200+ physical branches, offering conventional, FHA, VA, jumbo, and refinance loans through digital and in-person channels.

Biggest Difference:

Fincast = a comparison tool

LoanDepot = a direct lending source

💡 Pro Tip: Get a Loan Estimate from LoanDepot (or any lender), then upload it to Fincast to see whether vetted lenders can offer a more competitive deal (results may vary). No duplicate applications or credit pulls are required.

What Is Fincast?

Fincast is your lender comparison platform that creates transparent competition to win your business.

Fincast benchmarks your existing Loan Estimate against multiple pre-screened and licensed lenders, showing:

How your rate compares to current market offers

Which lenders can potentially offer more attractive terms

Competing offers without duplicate applications

Side-by-side cost breakdowns

Unlike applying to multiple lenders individually, Fincast requires a single upload. No extra credit pulls or spam.

Fincast is not a lender. Comparison results do not guarantee savings.

👉 Think of Fincast as a mortgage comparison engine, like shopping for flights on Expedia instead of visiting each airline's website individually.

What Is LoanDepot?

LoanDepot is a hybrid mortgage company that operates as a non-bank mortgage lender.

Founded in 2010, LoanDepot is one of the largest non-bank mortgage lenders in the United States, with more than 200 physical branches nationwide.

LoanDepot loan includes:

Direct lending (they underwrite and fund in-house)

Physical branches for in-person service

Digital platform for online applications

Loan products: conventional, FHA, VA, USDA, jumbo, refinance

LoanDepot offers a mix of digital convenience and traditional support, appealing to borrowers who value personal service.

Fincast vs. LoanDepot: Side-by-Side

Feature | Fincast | LoanDepot |

|---|---|---|

When You Use It | After you have a Loan Estimate to benchmark | When applying for a mortgage |

Purpose | Compare offers and find competitive rates and terms | Apply for and obtain a mortgage loan |

Accuracy | Shows real-time competitive offers from vetted lenders | Shows LoanDepot's current rates and terms |

Best For | Comparing lenders and potentially maximizing savings | Borrowers wanting in-person service |

How Should I Use Both When Buying a Home?

Both tools play a critical role—one helps you obtain a loan, the other helps you compare it.

Step 1: Apply for Your Loan

Start by applying with LoanDepot (or any lender you trust). Within three business days, you'll receive a Loan Estimate showing your rate, fees, and costs.

Step 2: Review Your Terms

Check your interest rate, APR, closing costs, and monthly payment. This becomes your baseline.

Step 3: Upload Your Loan Estimate to Fincast

Upload your LoanDepot Loan Estimate to Fincast. The platform instantly benchmarks it against vetted lenders to provide transparency and competition, if applicable.

Step 4: Compare Competing Offers

Review if any lenders have a more competitive offer than LoanDepot’s, all without completing multiple applications or triggering extra credit pulls (results may vary).

Step 5: Choose and Lock Your Rate

If LoanDepot has the best terms, proceed with confidence. If another lender offers better value, switch before closing. Then lock your rate to protect against market changes.

Why Transparent Competition Matters

Mortgage rates vary significantly between lenders. Without comparison, you may accept terms that cost more over the life of your loan.

A tool like Fincast gives you transparency in an opaque market. But there's an upside and a downside to shopping around.

If you skip comparison shopping, you'll never know if you overpaid. But manually comparing—applying to five lenders individually—is time-consuming and requires duplicate paperwork.

Pro tip: Use Fincast to automatically benchmark your offer, then decide whether to stay with your current lender or switch to a better deal.

Compare Offers Effortlessly Using Fincast

Comparing mortgage offers doesn't have to be hard. Use Fincast to instantly benchmark LoanDepot's rate and fees against vetted lenders by uploading a single Loan Estimate.

Fincast benchmarks your LE against vetted lenders to determine whether better offers are available.

No duplicate applications

No extra credit pulls

No spam

You get all the benefits of comparison shopping, both before and after choosing your lender.

FAQs

1. Is Fincast the same as LoanDepot?

No. Fincast is a reverse-auction platform that helps you compare lenders, while LoanDepot is a direct lender that originates loans.

2. When should I use Fincast?

Once you have a Loan Estimate from any lender (including LoanDepot), upload it to Fincast to see if other lenders can compete.

3. Can I switch lenders after using Fincast?

Yes. You can switch to any lender offering better terms before closing—there's no penalty for shopping around.

4. Does Fincast show LoanDepot offers?

Fincast benchmarks your existing offer (from LoanDepot or any lender) against other vetted lenders to help you compare.

5. How does Fincast help with LoanDepot?

Fincast shows whether LoanDepot's offer is competitive, helping you make an informed decision before locking your rate.

Bottom Line

Fincast helps you compare offers

LoanDepot helps you obtain a loan

With Fincast, you can compare, evaluate, and shop with confidence—all without multiple credit pulls or extra applications.

Pro Tips (Save These!)

Get a Loan Estimate from LoanDepot before benchmarking with Fincast.

Use Fincast even if you're happy with your current lender—you might discover better terms.

Use Fincast to benchmark any lender's offer, including LoanDepot's.

Action Checklist

Apply for your loan with LoanDepot and receive your Loan Estimate

Compare your rate and fees against your budget

Upload your Loan Estimate to Fincast for benchmarking

Review competing offers from vetted lenders

Choose the best deal and lock your rate

👉 Ready to compare smarter? Upload your Loan Estimate to Fincast and see if better offers are available today.

Disclaimer: Nothing in this content should be considered financial advice. The examples and data shared are for general information only and may not reflect your personal situation. We do not guarantee the accuracy or completeness of the information provided. Always do your own research and speak with a qualified financial advisor before making any financial decisions.